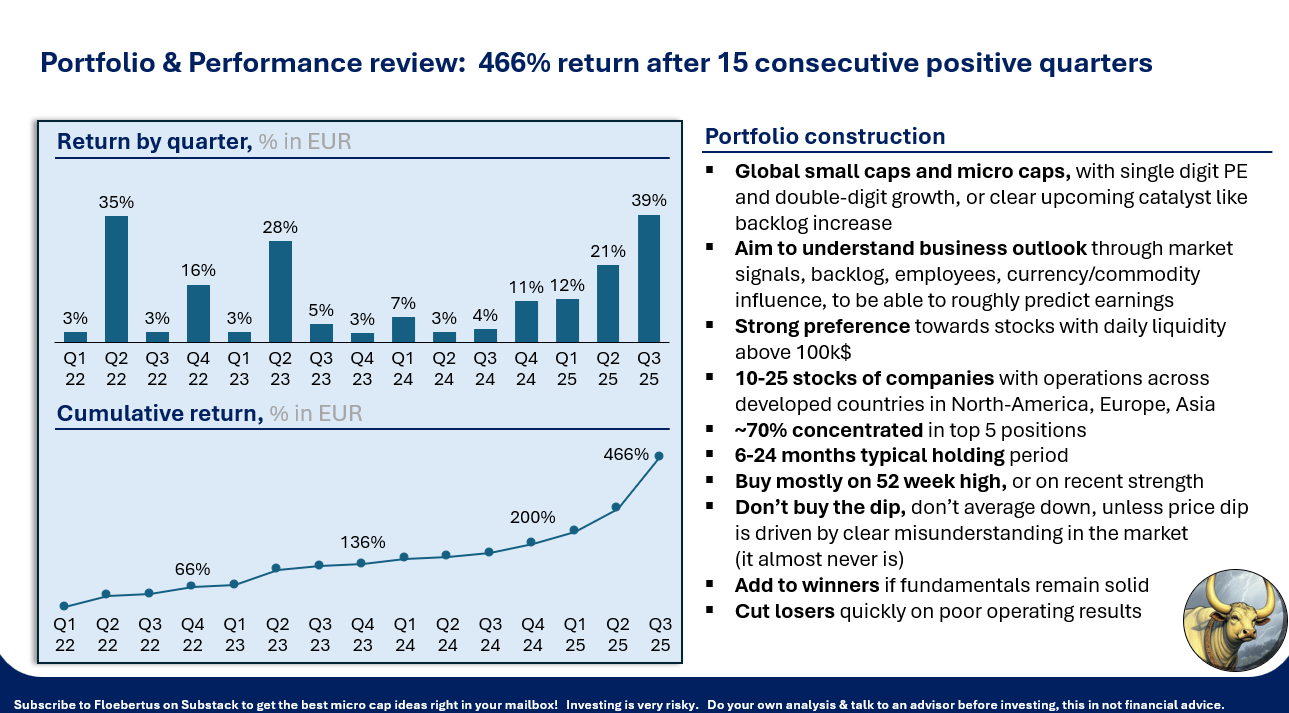

Portfolio & Performance review (Q3)

+89% YTD and ~5.5x since 2022

In this first quarterly update, I will:

Update you on my performance since Jan 1st, 2022

Review the performance of the 2025 write-ups

Share the current positions and % allocation for each stock in my portfolio

Describe the main Q3 changes and rationale + lessons from mistakes/winners

Close with a quick summary of why I own each stock in the portfolio

In late 2021, I started really digging into small and micro-caps. I would find small companies like Spyrosoft which no-one had ever heard about, trading at 12x earnings with 50% growth. I realized there were stocks nobody noticed and nobody cared about. You only had to search hard enough to find them, and understand them well enough to build conviction.

Since then, I look for single digit P/E stocks with years of growth ahead, slowly getting recognized by the market. I look at stocks globally. I analyze hiring trends, vacancies, product reviews, commodities involved, macro influence, competitors, currency effects, market perception … and pick the best stocks. As the portfolio grows, I include mainly stocks with daily volume > 100kUSD, so sufficient capital can be deployed and friction is limited.

Performance update

The returns so far have been excellent:

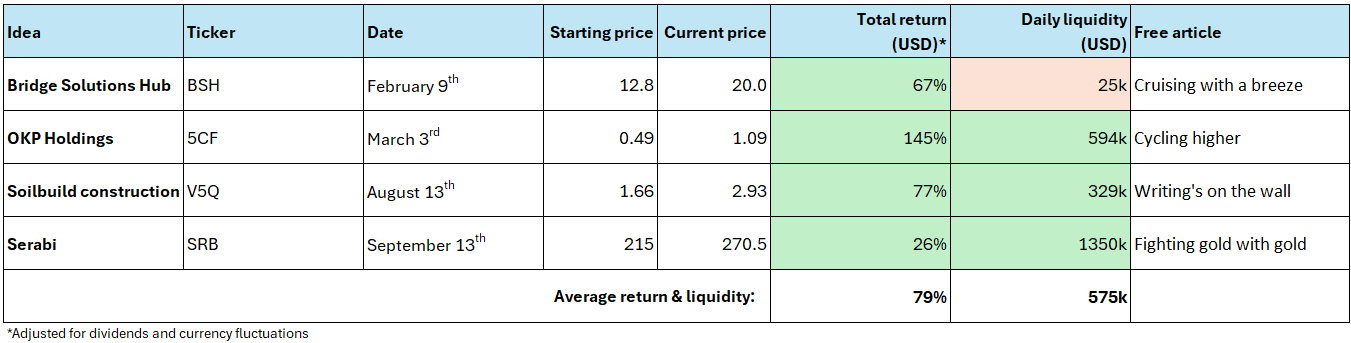

The 4 pitches written in 2025 are up 79% on average, in 4 months on average, with a 100% hit rate. Below is an overview of the companies written up, and their stock performance since each write-up.

There are 23 positions today (01/10/2025), with operations across 14 countries:

Altyngold (ALTN.L)

Serabi (SBI.TO)

Soilbuild Construction (V5Q.SI)

Keep reading with a 7-day free trial

Subscribe to Floebertus to keep reading this post and get 7 days of free access to the full post archives.