Poland's most interesting stocks

A look through Poland's stock market after Q2 earnings

Today we will look for the most interesting Polish companies, looking at their Q2 numbers which were posted over the past 2 weeks for most companies.

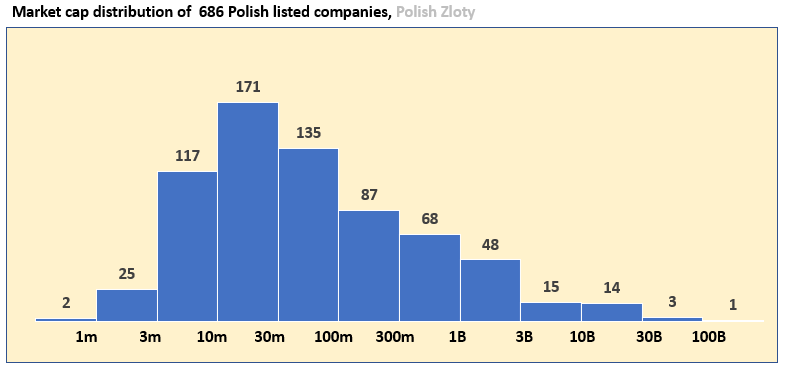

Poland has a lot of small companies, it’s a real hunting ground although some or less liquid then the companies we like to cover at Floebertus (>100k / day).

Poland has 686 public companies!

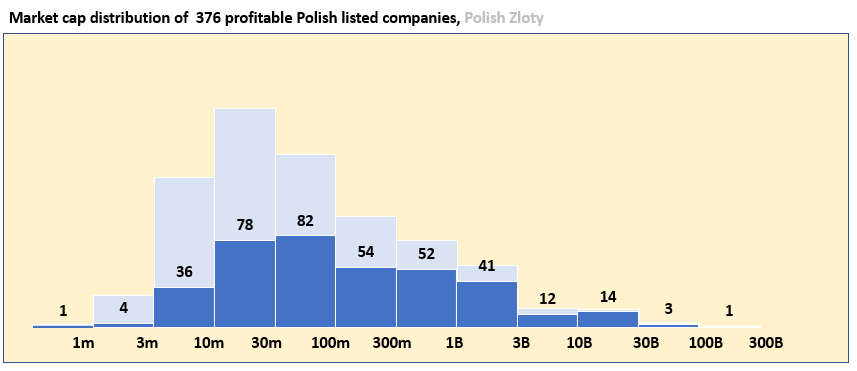

Let’s look at only the profitable ones:

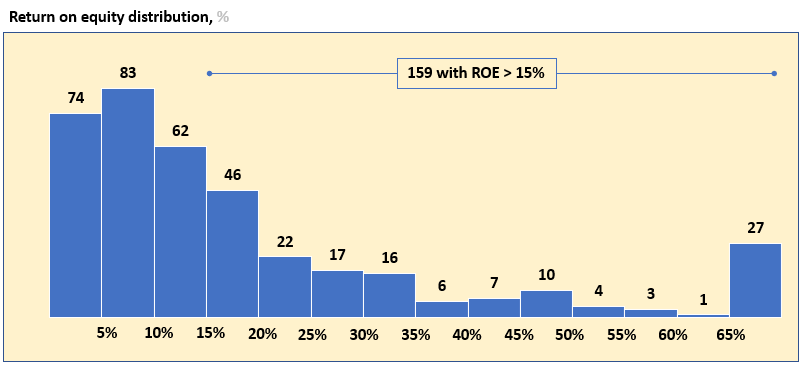

We want great companies that can compound our capital, we look for ROE >15%:

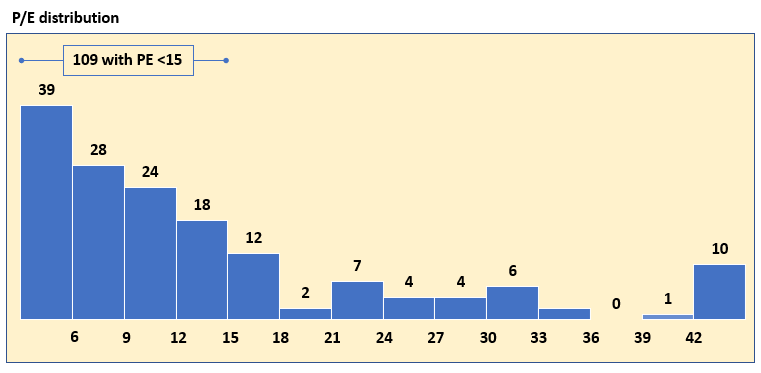

My favorite thing about Poland is that its very, very cheap. There’s over 100 high quality companies that are actually at a PE < 15x. This is amazing!

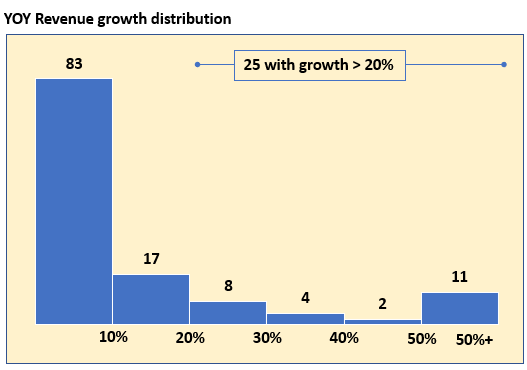

The only way our small companies will become big, is growth. We look for serious revenue growth:

We don’t like to make things complicated, or to put our feet on an unstable ship. We exclude building companies, banks, gaming companies, solar panels, energy retail, … Things that we don’t understand, or that make profit today to cover the losses of tomorrow…

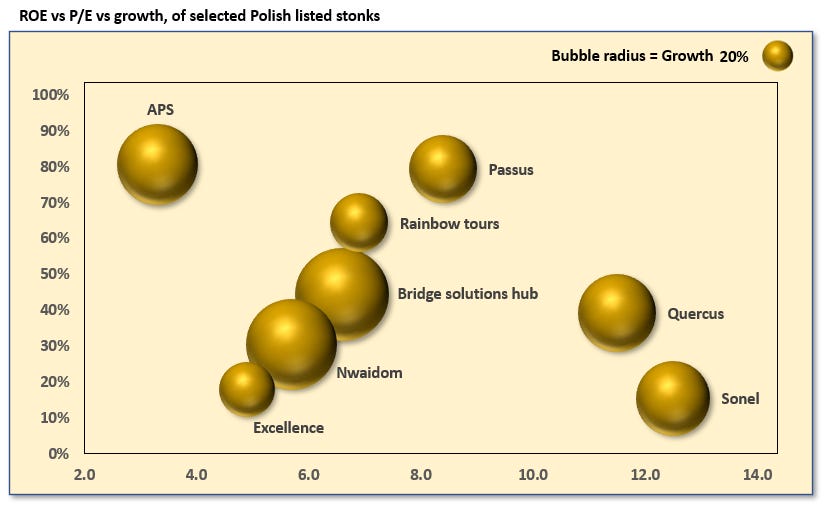

We end up with 8 top companies, from a factor point of view:

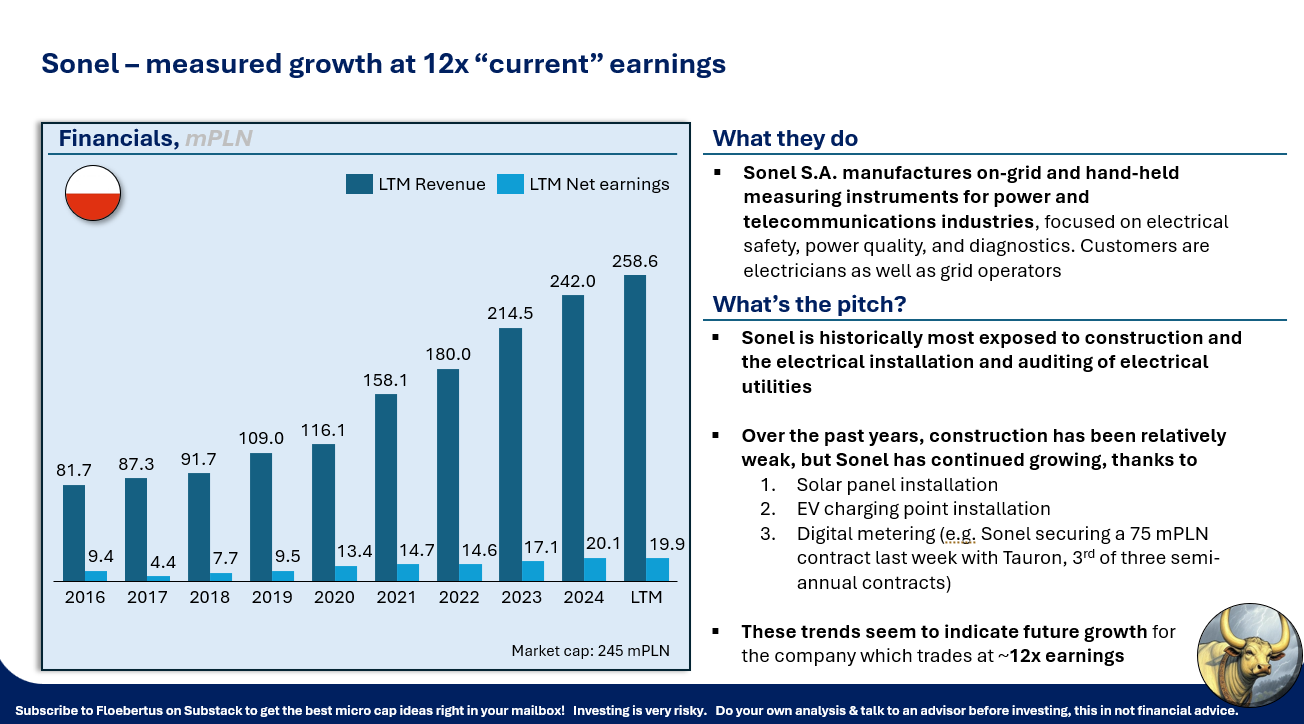

Going of the right, we see Sonel, a compounder benefiting from EV, digitization and other electrification trends that prints one excellent year after another:

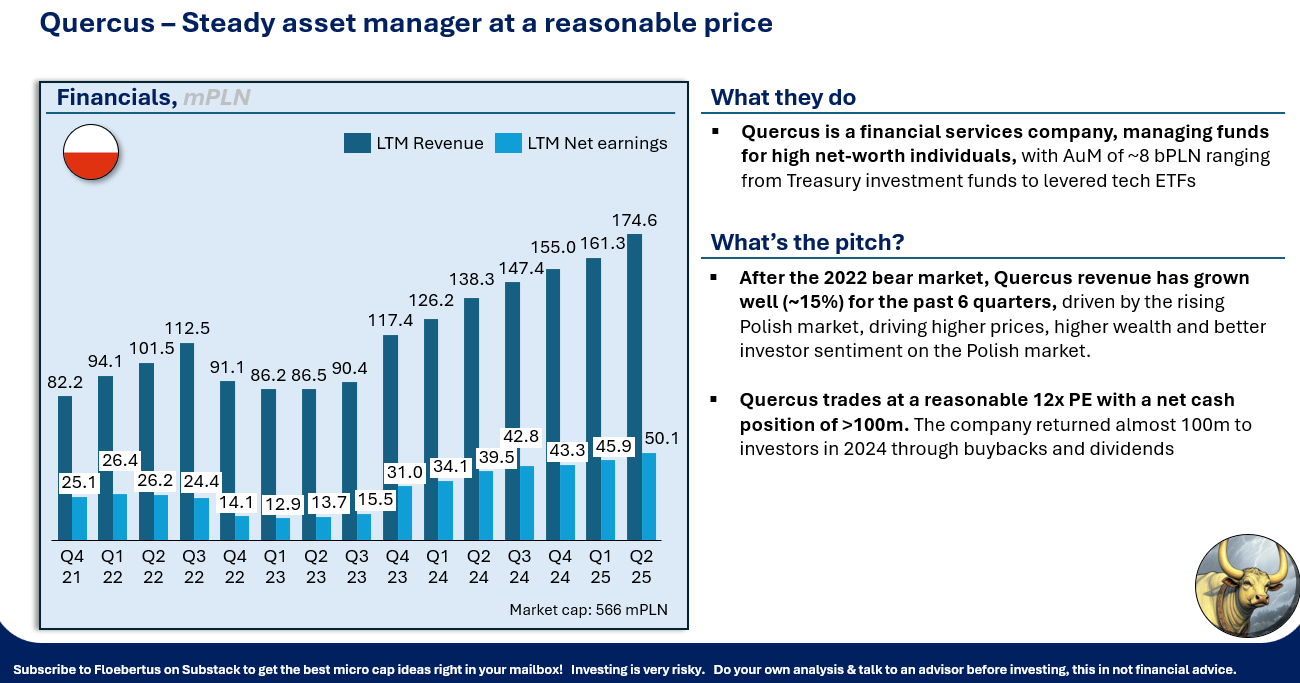

Next up, we have asset manager Quercus, arguably joining the group thanks to the Polish bull market driving up assets and therefore income:

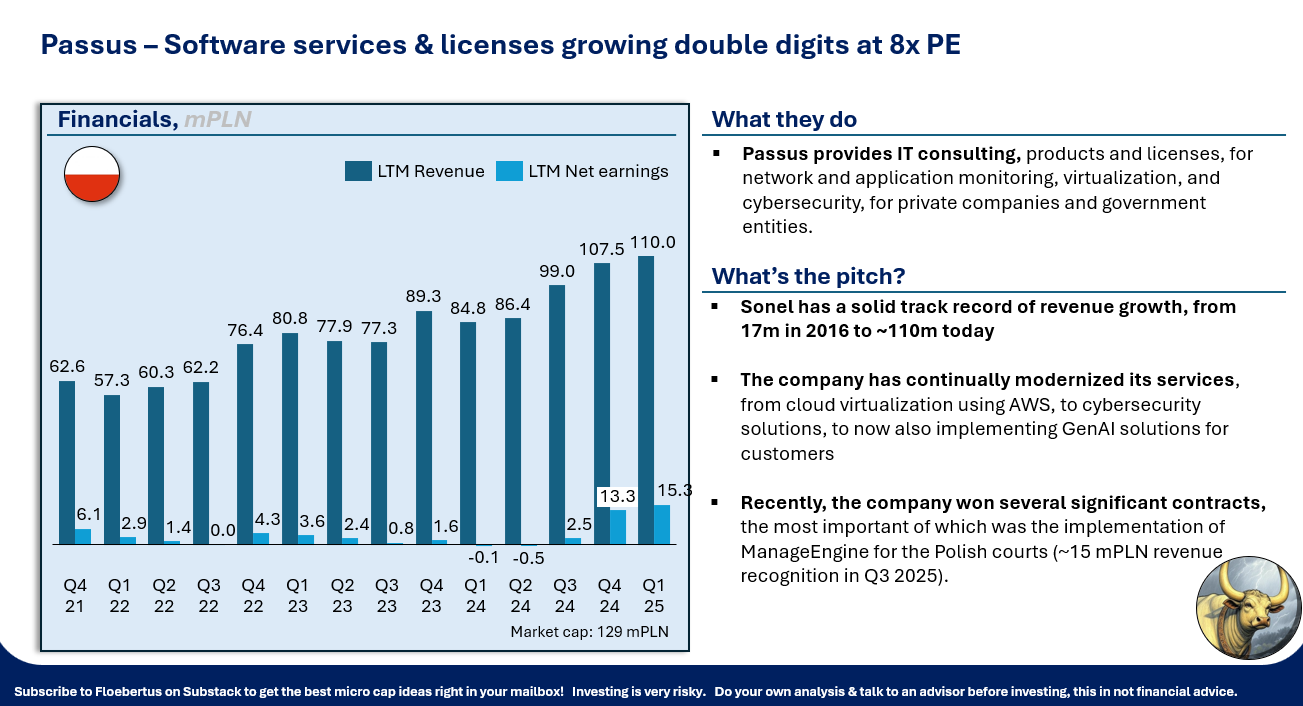

Another interesting digital stock is Passus sa. The company work on IT integration, implementing things like Amazon cloud and ManageEngine. This is quite an interesting company, specially because their recent contract win means Q3 revenue growth is a certainty.

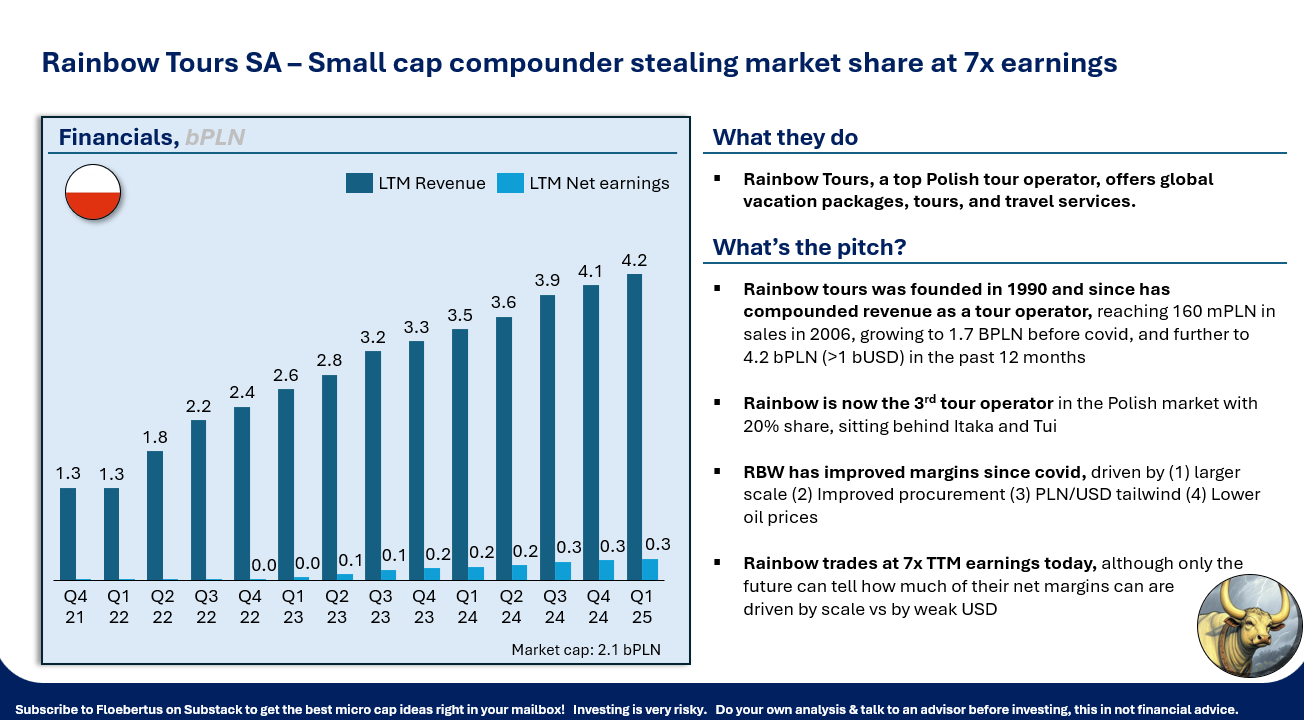

Rainbow Tours sa is also in our list. A travel company or tour operator. This is a bit surprising because Rainbow is a company that very very consistently posts growth, and takes share from competitors. Investors going for it should be careful though as margins are slim and benefit from weak oil and weak USD/EUR vs PLN. This trend seems to continue, so they will likely do well in the short term:

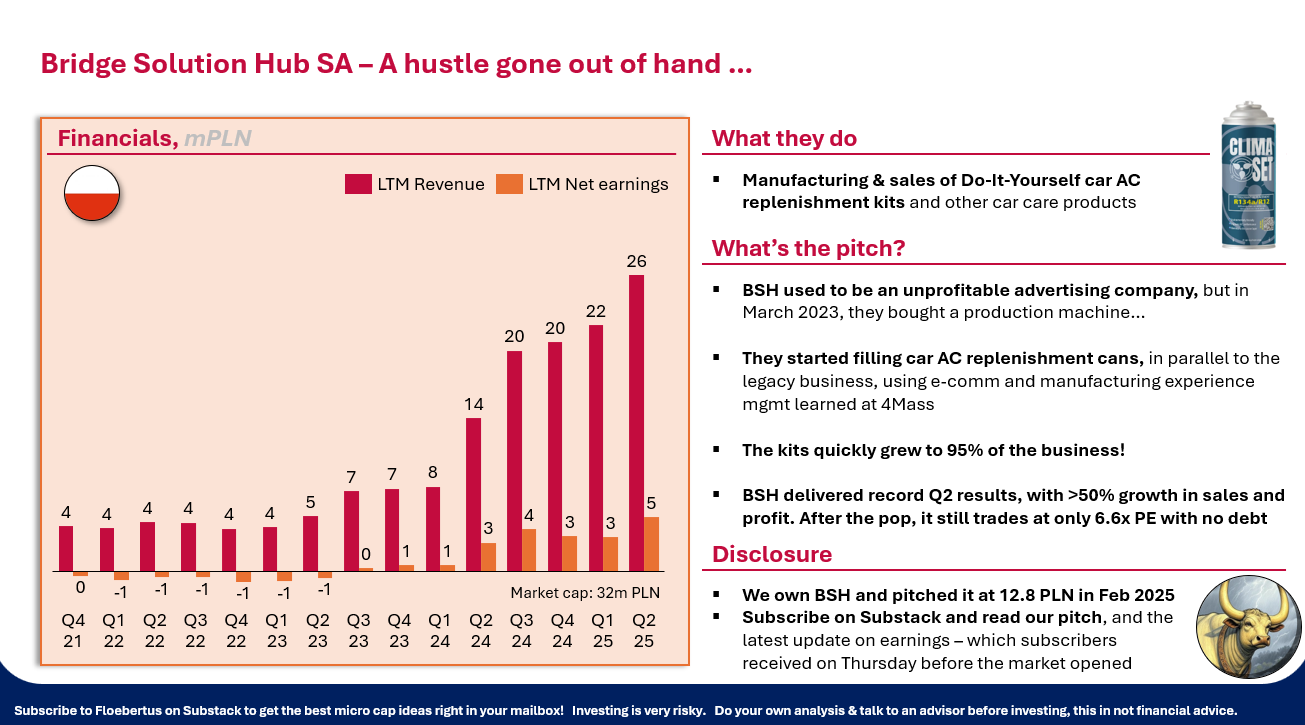

Bridge Solutions Hub is still one our favorite Polish stocks, even though it has run up a bit. The company should do very well in Q3 given weather conditions, and this will make it even cheaper than it already is. We posted a full review of the companies’ earnings 2 weeks ago:

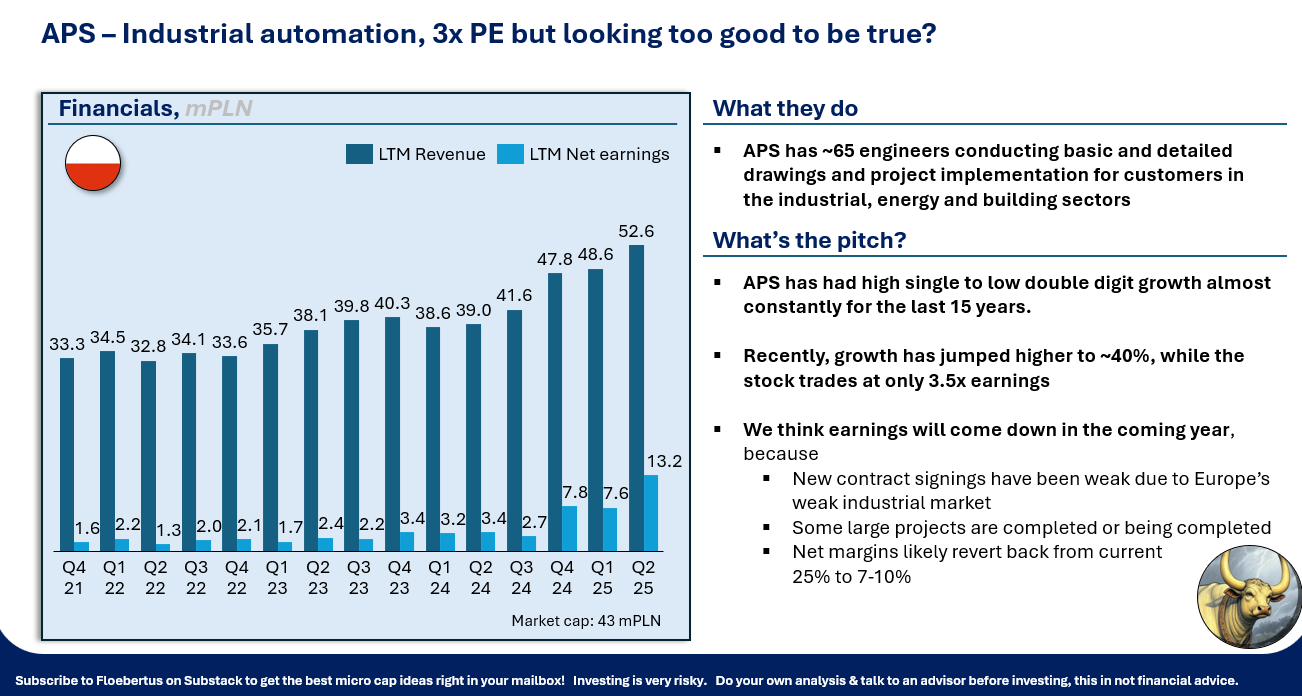

APS is an interesting automation company which we did want to highlight as it has made a lot of progress, although the company did give weak guidance in their latest earnings report:

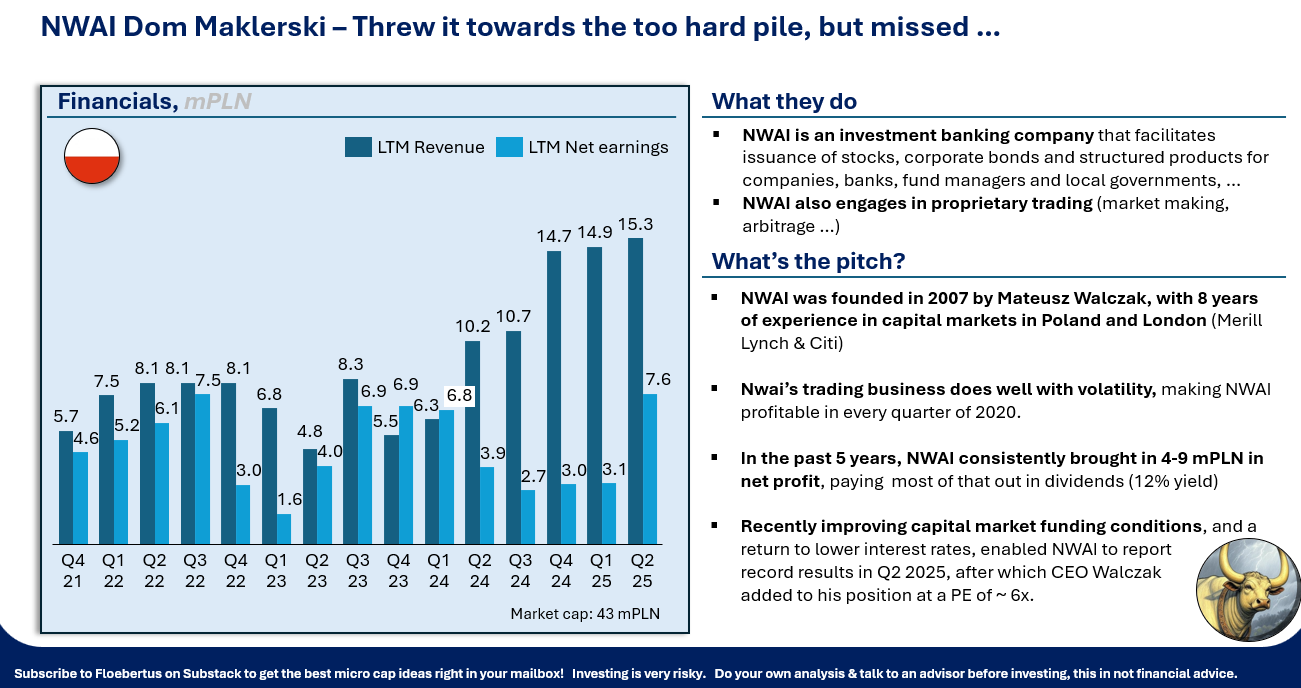

NWAI dom Maklerski is a small company which should do well as rates come down and capital market conditions loosen up:

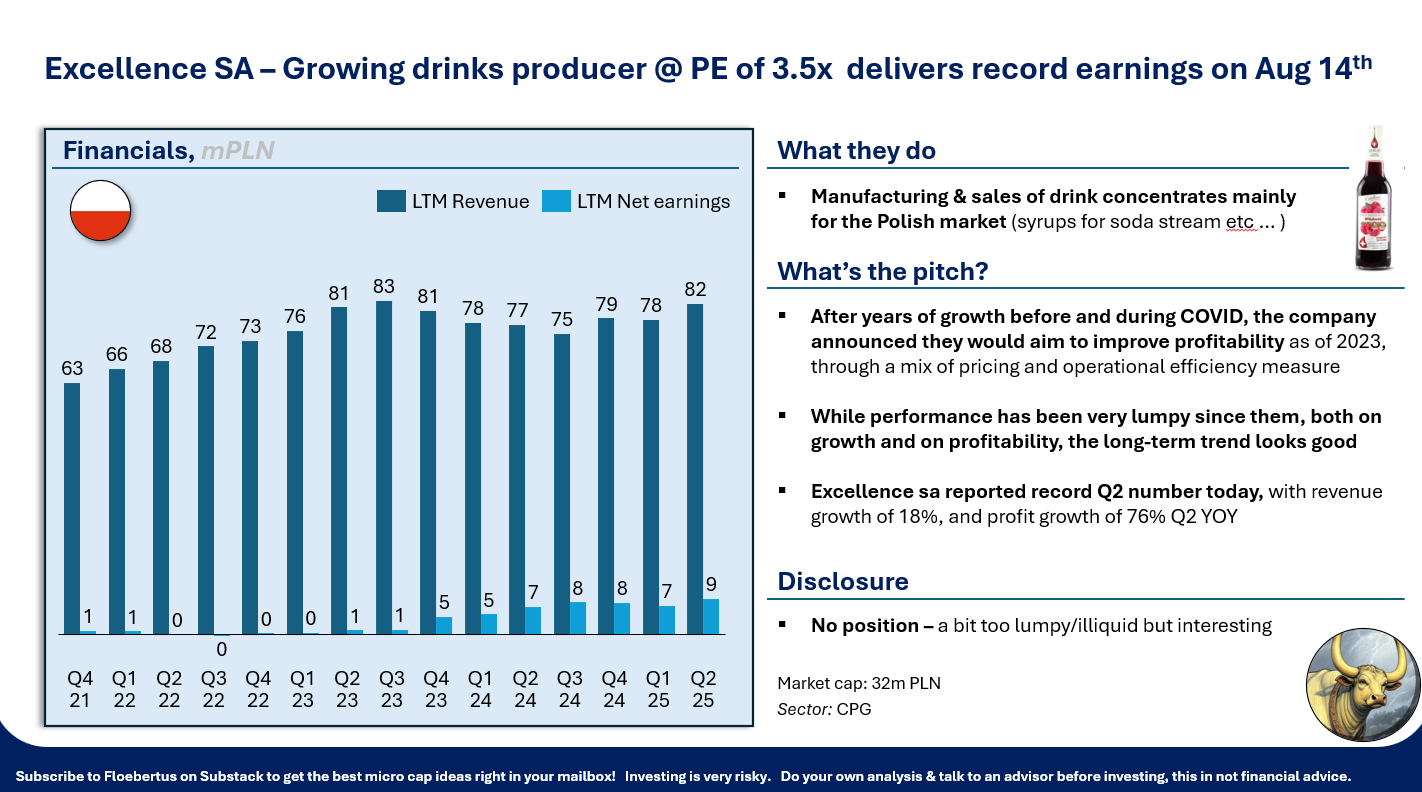

Finally, we posted about Excellence, 2 weeks ago:

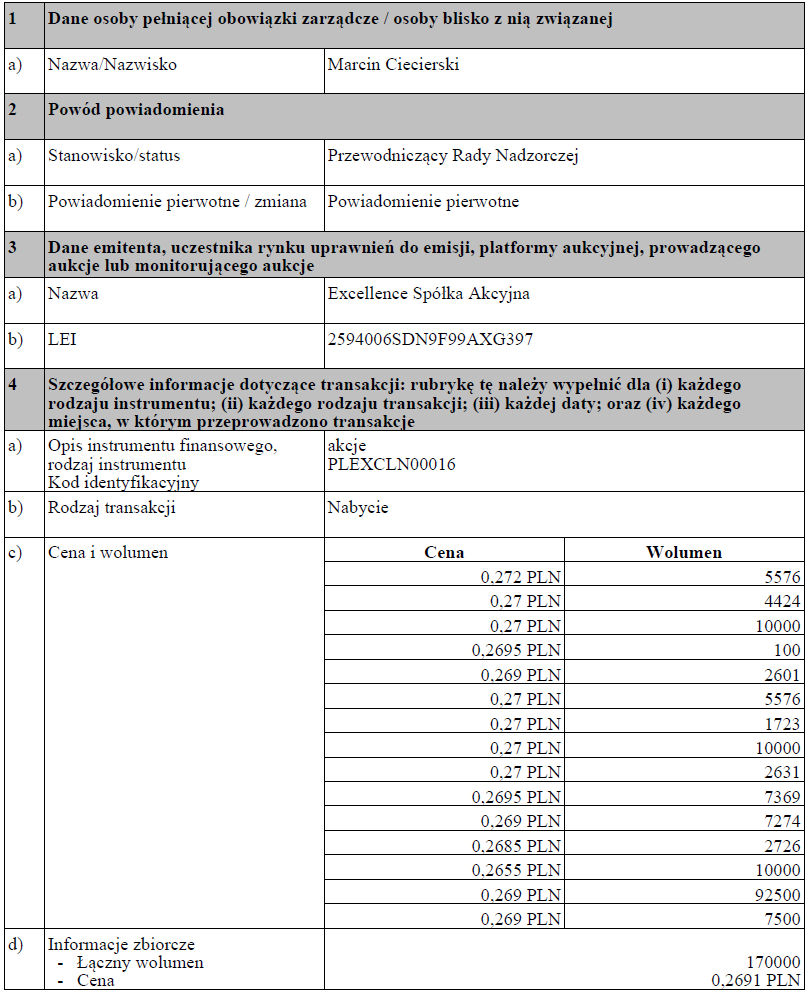

Since then, the stock is up 40% to a PE closer to 5x PE. You might think our followers piled into the stock, but it was actually the chairman piling in, and buying almost a million shares right on the ask over several days this week and last week. We don’t really like Excellence, it’s so small it feels like parking in a tight spot in Brussels…

Disclosure

We have shares in some of the companies mentioned above. Subscribe to Floebertus to see the full list of positions 2 weeks before the end of every quarter, as well as interim updates on large position changes, company interviews, earnings reviews and alerts on big events like large contract wins. The first portfolio overview will be posted on September 13th.

Disclaimer

This publication’s authors are not licensed investment professionals. Nothing produced by the Floebertus team should be construed as investment advice. Investing involves serious risks, including risk of capital, as well as health risks. Do your own research before investing, and size your positions appropriately, in line with your own conviction and your own knowledge.

Live in Poland part time in the summer. Just take a train anywhere and you see all new factories and buildings. Also the road systems have been (And continue to be) expanded and upgraded. Wonderful country!

What do you use for screening?