Huationg Global Ltd.

A great company hidden behind a phased out one-off project

Today’s write-up covers a company with unique characteristics:

Founder led civil engineering leader

Over 2x revenue in its order book for the next 3 years

Over 30% revenue growth in its core segment, over 3 years

3.5x cash adjusted P/E and ~0.8x price/book

~75% insider ownership

The great performance of the core business is hiding behind a fully phased out one-off project in a completely different line of work, making it harder for investors to recognize the quality of the business without looking beneath the surface. Let’s dive in.

Ticker: 41B (SGX)

Price: SGD 0.53

Shares Outstanding: 177m

(No dilutive shares/options/warrants)

Market Cap: SGD 94m

Net Cash/Debt: +48m

Overview

Huationg Global Limited is a Singaporean civil engineering firm, specializing in infrastructure projects such as tram and subway stations and rails (called MRT in Singapore), highways, and excavation works. Notable projects include supporting the Circle Line railway and the “Thomson-East Coast Line” railway, besides several residential construction projects.

The stock is attractive because:

The company’s core business is growing at double digits (~40%)

Their backlog is over 2 years of revenue, giving future growth visibility

The stock trades at ~3.5x earnings

(market cap - net cash) /(profit - net interest income)Singapore’s construction sector is being awarded ~50 billion SGD in contracts this year, creating a great market for construction companies in 2025-26-27

Segments & core business growth

Huationg Global, founded in 1980, employs ~900 staff and operates across 3-4 segments:

Civil Engineering Works (93% of H1 2025 revenue)

Huationg delivers comprehensive services for infrastructure, encompassing earthworks, piling, structural engineering, and deep basement excavations for public-sector projects like MRT expansions and road tunnels. Key clients are the Singaporean Land & Transport Authority (LTA), the Housing & Development Board (HDB), and private developers.Inland Logistics Support (6% of H1 2025 revenue)

This segment provides haulage, material transportation, and equipment rental (e.g., tipper trucks, excavators) to construction sites, enhancing supply chain efficiency for internal and external use.Sale of Construction Materials (1% of H1 2025 revenue)

Huationg supplies specialized items like soil stabilizer, primarily to its civil engineering projects for cost optimization, but also with growing external sales.Dormitory operations segment (0% of H1 2025 revenue)

In 2020-2021, Huationg designed, constructed and started operating a dormitory in Changi, which can house over 10,000 people. This dormitory is basically a hostel village housing mainly immigrant workers who left their country to build a future for themselves and for Singapore. Dormitory operations is not a core business for Huationg, and is not something they are good at, and so in 2024, the highly profitable dormitory business contract was not extended and was taken by another company.

Past revenue growth

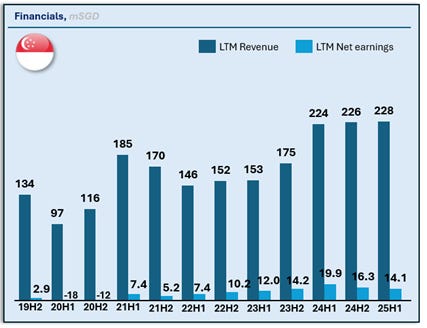

Looking at the past 5 years of revenue, we should not be too impressed with the recent growth:

We see the company struggled through covid and then went into growth mode in 2021, but H1 2025 seems weak. Looking at the segment breakdown though, we see a great civil engineering business, hiding behind a one-off dormitory business which has been phased out:

Huationg’s civil engineering segment has grown from ~53 mSGD in H1 2022, to over 112 mSGD in H1 2025, and is doing better than ever. Although Huationg’s dormitory segment was highly profitable, it does seem to have been a management distraction, hindering the growth of the company in late 2022 and early 2023 as dormitory operations were starting up.

COO Mr Vincent Ng Kian Yeow was running both the Dormitory operation as well as the overall civil engineering business during those years. With the dormitory operation now fully handed over to another contractor, the civil engineering segment is growing at 30-40%. Which makes us wonder if the momentum will continue…

Backlog & forward revenue visibility

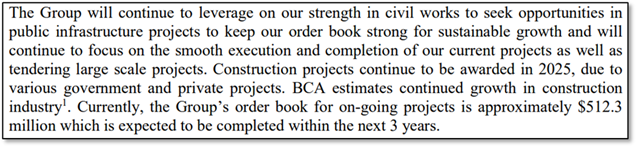

To understand if the current strong revenues will continue to grow in the future, we can look at Huationg’s backlog. In the H1 report, the company states:

Qualitatively, this sounds great. Growth in Singapore public and private construction demand, leads to a high number of projects being awarded in 2025, leads the company to keep bidding and executing to support future growth.

Quantitatively, we look at the 512 mSGD order book. This order book likely consists of 95% or more of civil engineering contracts, because there’s no sense in ordering construction materials or logistics more than 6 months in advance. At 512mSGD, the order book to be completed in the coming 3 years of already confirmed orders is already 15% higher than the civil engineering revenue achieved over the past 3 years. As the company continues selling more contracts, and continues executing, it looks well set up to continue growing.

Valuation

Huationg has a 94 mSGD market cap, having 177 million shares out, at 0.53 SGD per share. It has no dilutive options or warrants, and minority interests are less than 1% of net income. Huationg’s last 12-month net income was 14.2 mSGD, giving it a P/E multiple of ~6.7x.

The company’s cash position of 106 mSGD sits just above its 94 mSGD market cap. Taking out debt, net cash is at 48 mSGD. Management wants to use this to fund further organic growth.

Cash adjusted PE ratio is (94-48)/(14-0)=46/14 = ~3.5x. The company has a strong balance sheet and trades at 0.8x price/book.

Net margins are at 7-8%, sitting below peers, as Huationg delivers slightly more basic engineering work, and takes less end-to-end responsibility of large (>100 mSGD) projects. We expect the strong Singaporean construction demand, and the ambition of the Huationg team to grow into larger projects, to both be tailwinds on profit margins as well as revenues.

We think fair value is 8-12x ex-cash PE, or 48 + (8 to 12) x14, or 0.90 – 1.22 SGD / share compared to Friday’s closing price of 0.53 SGD.

Leadership and Ownership

Mr. Ng Hai Liong, Chairman of Huationg, who founded Huationg Contractor in 1980, leads the company together with his 2 sons, CEO Ng Kian Ann Patrick and COO Ng Kian Yeow Vincent.

The 3 Ng’s own a majority stake in the company, through:

Dandelion Capital, their shared holding, owning 68% of Huationg’s shares (~122m sh.)

Personal shares, CEO Ng Kian Patrick owning ~15m shares, mostly from open market purchases throughout 2024.

Risks

Investing is very risky, only a few examples of risks investing in Huationg are:

Civil engineering projects often are lumpy, can be delayed or can be cancelled for reasons within or beyond the control of the company

Rising commodity prices (for example due to an improving Chinese construction sector) can dampen profit margins for the group

Future retirement of the Group’s Chairman, the founder and current strong man in the company, may create a rivalry between his sons in setting the direction of the company

We think risks in investing in small companies are very large, although this might not be our highest risk write up. The relatively good track record and forward visibility of the country, the sector and the company itself, and the large cash position provide some downward protection in most scenarios.

Summary

Huationg Global, an A1 construction firm in Singapore, is quickly ramping up its civil engineering revenue, while keeping its order book strong by winning new projects. Over the past 2-3 years, the civil engineering segment has doubled, though recent growth is hiding behind the phase out of a one-off non-core business.

Forward growth looks baked in the cake, with a strong 3-year order book sitting above 2x current revenue run rate, amidst years with large ongoing public and private infrastructure investments in Singapore.

At the current price of 0.53 SGD, Huationg Global trades at a 3.5x net-cash adjusted PE, and at a Price to Book of 0.8x. We think fair value is at an 8-12x net cash PE ratio, or 0.90-1.22 SGD, providing ~100% upside from today’s price, or a 50% margin of safety.

Disclosure - long